About Us

Successful entrepreneurship according to Islamic principles.

El-Wafa’ is an independent consultancy firm specializing in Islamic entrepreneurship, finance and business advisory services. Leveraging our extensive expertise and practical experience, we provide strategic and customized solutions designed to meet the unique needs of businesses and organizations.

Our methodology combines innovation with strict adherence to Islamic law, while thoughtfully incorporating local legal and fiscal frameworks, ensuring that our solutions are impactful, practical and ethically grounded. We are committed to fostering the sustainable growth of our clients in alignment with Islamic values and principles.

Our Mission

Our Vision

Our Team

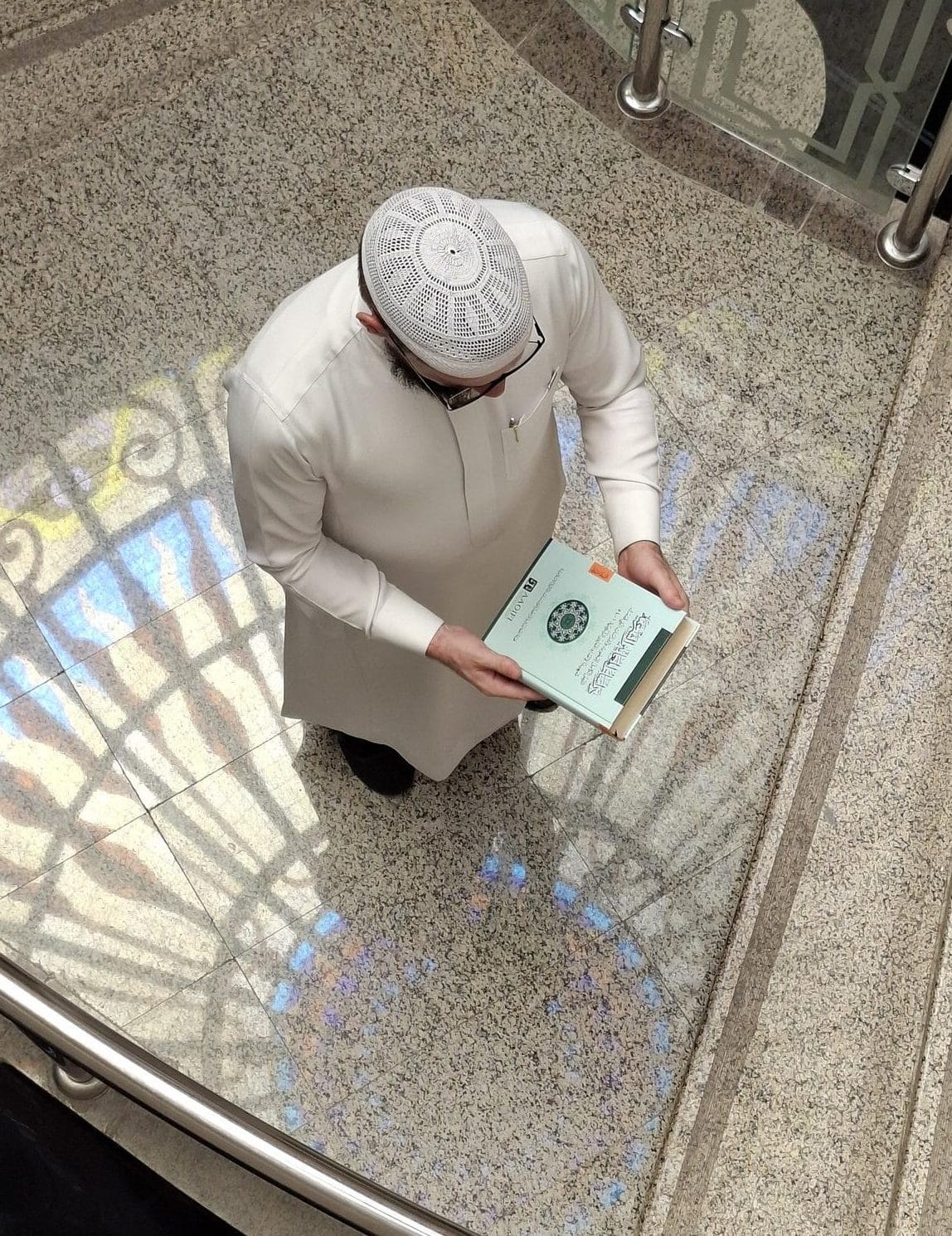

Erik Lesterhuis is a specialist in Islamic business and finance and is the lead consultant at El-Wafa’ Consultancy. He has extensive experience advising both corporate and private clients across various countries, including the Netherlands, Belgium, the United Kingdom, Malaysia, and Morocco.

Erik holds a Master’s degree in Islamic Finance Practice from INCEIF, The Global University of Islamic Finance in Malaysia, as well as a second Master’s degree in Islamic Economics from the Islamic University of Medina, Saudi Arabia, where he also obtained a Bachelor’s degree in Shariah. His practical advisory approach is grounded in his extensive experience as a business consultant, complemented by a Bachelor’s degree in Small Business and Retail Management from The Hague University of Applied Sciences.

Additionally, Erik has earned various professional qualifications in the Islamic financial sector, including the Islamic Finance Qualification (CISI), the Diploma in Islamic Finance (CIMA), and is a certified Shariah Advisor and Auditor (CSAA) with the internationally recognized Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI).

Academically, Erik is actively involved in the development of innovative Islamic financial solutions in Western countries, with the aim of supporting sustainable socio-economic development globally.

Erik is multilingual and provides advisory services in English, Arabic, or Dutch, depending on his clients preferences.

How we work

Reach out to us with no obligation. We’ll think along with you and provide a proposal. A videocall can be scheduled if needed.

We begin the development process and keep you updated.

Together, we assess the solution and make necessary adjustments.

Smooth integration and continuous support available at all times.

Contact us

Why choose us?

Expertise in Islamic Finance and Entrepreneurship

Innovative Shariah-Compliant Solutions

Client-Focused Support

Commitment to Excellence and Quality

Frequently Asked Questions

El-Wafa’ means dedication and loyalty in Arabic. The name reflects our commitment and expertise to deliver reliable and effective, tailor-made solutions that seamlessly align with the business and ethical objectives of our clients. This is done fully in accordance with Islamic principles, regulations and internationally recognized Shariah standards within the Islamic finance sector.

In short, Islamic finance is a financial system based on Shariah that focuses on ethical investments and balanced risk-sharing. Issues such as “riba ” (interest), “gharar” (excessive uncertainty in the terms or outcomes of a transaction), other harmful effects, and injustice are strictly prohibited. The system promotes transparency and integrity in all financial transactions, with the aim of achieving sustainable economic growth.

In a nutshell, Shariah refers to the body of Islamic law that governs the actions of individuals and organizations. It encompasses the ethical, legal, and social principles derived from the Quran, Hadith (teachings and practices of the Prophet Muhammad), Ijma (consensus of scholars), and Qiyas (analogical reasoning). It serves as a comprehensive guide for all aspects of life, including business and finance.

Shariah-compliance is crucial in Islamic finance as it provides financial transactions with guidelines based on the ethical and legal principles of Islamic law, or “Shariah.” These principles ensure that transactions are fair, transparent, and free from prohibited elements such as “riba” (interest), “gharar” (excessive uncertainty in the terms or outcomes of a transaction), harmful consequences, and injustice. This fosters a just and socially responsible financial system that promotes sustainable economic growth.

Riba refers to any guaranteed interest, profit, or benefit derived from a loan, and also includes the unequal exchange of goods of the same type, resulting in unjust enrichment.

In transactions, riba manifests in two primary forms:

“Riba al-Nasi’ah”: This refers to interest charged on loans or deferred payments and is the most common form of riba. Since this guaranteed interest does not represent a return derived from actual economic activities such as trade, it is considered unjust enrichment and is prohibited under Islamic law.

“Riba al-Fadl”: This involves the unequal exchange of goods of the same type, such as gold for gold. When one of the exchanged items is in surplus, it results in unjust advantage for one party, making it equally prohibited.

Gharar refers excessive uncertainty in the terms or outcomes of a contract or transaction, which is avoided to promote clarity and fairness in financial dealings.

Islamic finance encourages shared risk and reward between parties, promoting equitable partnerships rather than fixed returns.

A sale involves the exchange of tangible assets or services at mutually agreed terms, unlike riba which involves guaranteed interest on loans.

Mudarabah is a profit-sharing partnership in Islamic finance where one party provides the capital, and the other party manages the business. Profits are shared based on a pre-agreed ratio, while any losses are borne by the capital provider. It shares similarities with venture capital or silent partnership structures in traditional finance.

Musharakah is a form of partnership in Islamic finance where two or more parties contribute capital and share both profits and losses based on their investment or an agreed-upon ratio, always in accordance with Shariah principles.

This structure is similar to a general partnership or a private limited company with multiple shareholders.

Ijarah is a lease agreement where the right to use a specific asset (such as a vehicle or building) is rented to another party for an agreed period and fee, without transferring ownership. In Islamic finance, Ijarah is similar to operational leasing but with specific conditions based on Islamic regulations.

We offer a comprehensive portfolio of specialized services in Shariah-compliant Islamic finance and business consulting. This includes strategic Shariah advisory, product development, compliance audits, investment screening, training, and specialized research, all focused on successfully achieving our clients’ business objectives within the framework of Shariah and applicable local and tax laws.

Our consultancy methodology combines detailed textual analysis, practical application, and continuous client collaboration in a transparent process that begins with understanding your needs, followed by tailored development, joint evaluation, and seamless integration with ongoing support—ensuring solutions that are both Shariah-compliant and market-ready.

AAOIFI (Accounting and Auditing Organization for Islamic Financial Institutions) is an international organization that develops standards for Islamic financial institutions. The AAOIFI standards include specific regulations governing the activities and financial relations of companies to ensure they are Shariah-compliant. For example, companies engaged in sectors such as gambling, interest, alcohol, weapons, and tobacco are excluded. With their application in over 45 countries, the AAOIFI standards serve as an internationally recognized framework within the Islamic financial world. At El-Wafa’ Consultancy, these standards form the backbone of our services, ensuring we provide our clients with certainty, integrity, and international consistency.

Simply contact us for an initial discussion. We’ll evaluate your requirements and create a Shariah-compliant strategy designed to meet your specific goals and circumstances.

By incorporating Islamic financial solutions, businesses not only gain access to new markets and enhance their reputation but also promote sustainable partnerships. This approach brings barakah (blessings) into their operations, as it is rooted in the principles of fairness, transparency, and ethical conduct. This fosters long-term success, grounded in integrity and social responsibility.